Understand what percentage of your earnings is going toward forced savings so you can manage your monthly budget.By making use of deductions, the tax liability can be optimized.If an employee wants to switch, he/she can compare the packages being offered by different jobs. Employees can compare different jobs on the basis of these slips.These salary slips prove as an evidence of income of the employee.

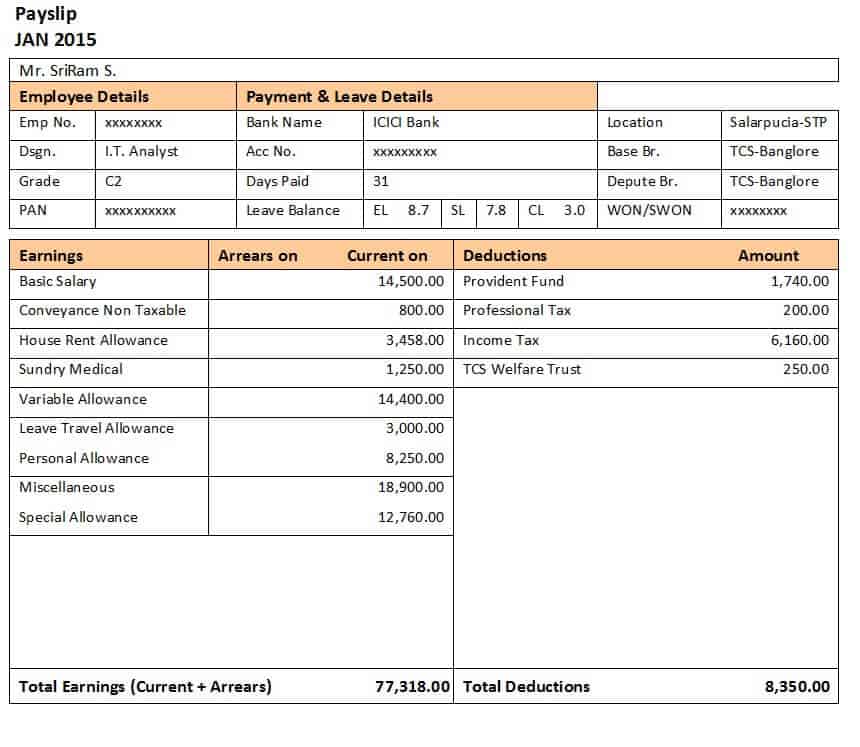

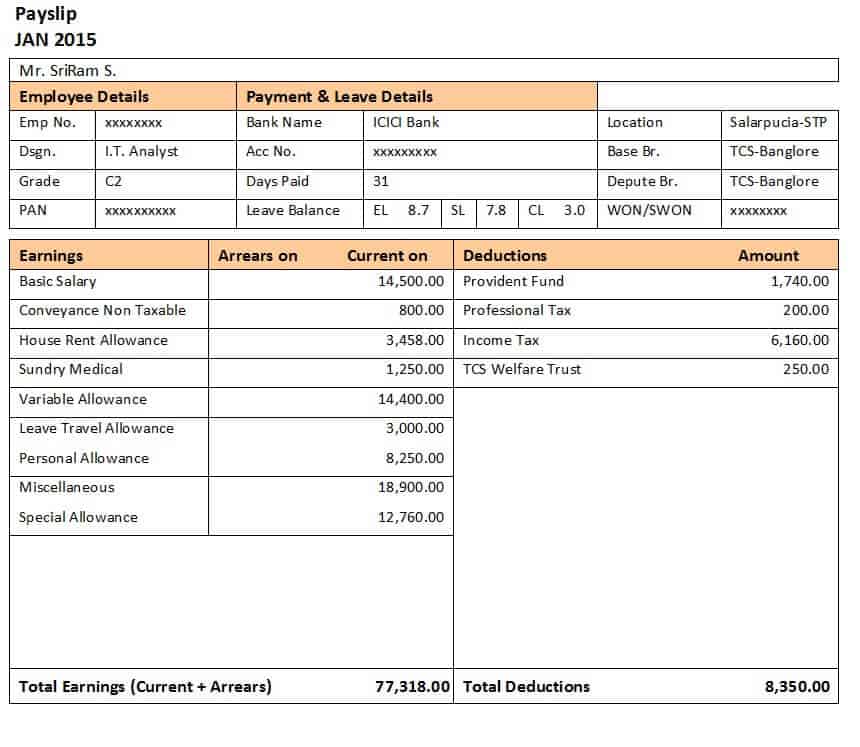

When employees want to seek loans or credit cards. The uses can include but are not limited to: These salary slips can prove to be very useful for employees. Deductions – provident fund, taxes, etc. Any other income – if an employee earned any other money through the company in the month, it is also mentioned on the salary slip. Bonuses or special allowances – all the bonuses for a month are mentioned. Medical allowance – this includes insurances provided by the company. Conveyance allowance – this is often given to the employee to manage transport to and fro work. Rent allowance – the amount is mentioned on the slip for the house rent given to the employee. Basic salary – this is a 100% taxable income and is the basic wage that will be given in terms of cash. Details of employee and company – this includes personal and professional details such as name, employee number, etc. Irrespective of the format used, there are certain things that are an essential part of a salary slip and all companies include them. Companies can even make their own formats. Some organizations may use Microsoft Word templates and other may use Excel. Even the programs used for making salary slips vary.

When employees want to seek loans or credit cards. The uses can include but are not limited to: These salary slips can prove to be very useful for employees. Deductions – provident fund, taxes, etc. Any other income – if an employee earned any other money through the company in the month, it is also mentioned on the salary slip. Bonuses or special allowances – all the bonuses for a month are mentioned. Medical allowance – this includes insurances provided by the company. Conveyance allowance – this is often given to the employee to manage transport to and fro work. Rent allowance – the amount is mentioned on the slip for the house rent given to the employee. Basic salary – this is a 100% taxable income and is the basic wage that will be given in terms of cash. Details of employee and company – this includes personal and professional details such as name, employee number, etc. Irrespective of the format used, there are certain things that are an essential part of a salary slip and all companies include them. Companies can even make their own formats. Some organizations may use Microsoft Word templates and other may use Excel. Even the programs used for making salary slips vary.

Different companies use different formats.

0 kommentar(er)

0 kommentar(er)